Finding Your Ideal Mortgage Rate: What Number Are You Waiting For?

webadmin • August 30, 2024

Finding Your Ideal Mortgage Rate: What Number Are You Waiting For?

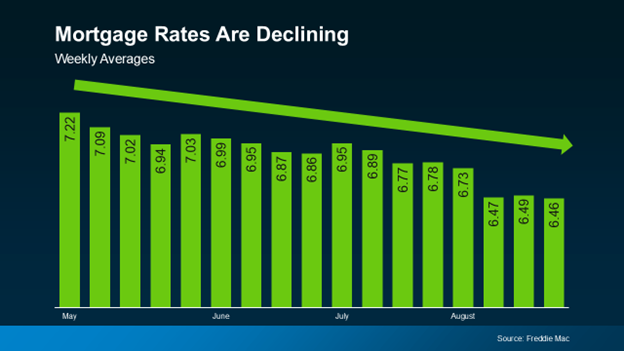

If you’ve been keeping an eye on the housing market the last few years, you likely already know how much the mortgage rates have significantly impacted the industry. Many people (maybe yourself included) have found it extremely challenging to afford jumping into the market. However, recent developments offer some encouraging news—

mortgage rates have begun to decline, reaching

some of the lowest levels we’ve seen

so far in 2024.

This shift raises an important question: what mortgage rate are you waiting for before making your move? Let’s explore the current economic landscape, expert predictions, and how you can determine the right rate for your home-buying journey.

Understanding the Current Economic Situation

The Federal Reserve has played a crucial role in managing inflation and stabilizing the economy, particularly in the aftermath of the COVID-19 pandemic. According to Chair Jerome Powell, the most severe economic distortions from the pandemic are fading, leading to a significant decline in inflation. As a result, mortgage rates have started to fall. Powell expressed confidence that inflation is on a sustainable path back to the Fed’s 2% target, which has been instrumental in the recent drop in mortgage rates.What Are Experts Predicting for Mortgage Rates?

Economic experts generally agree that as inflation continues to ease, mortgage rates are likely to follow a downward trajectory. However, this doesn’t mean rates will decrease in a straight line—there will likely be some fluctuations as new economic data emerges. Despite these short-term variations, the overall trend is promising. Compared to the peak rates seen earlier this year, we’ve already experienced a decline of about one percentage point.

For example, Realtor.com recently revised its 2024 mortgage rate forecast, predicting that rates could average around 6.7% for the year and potentially dip to 6.3% by year’s end. This optimistic outlook is based on the expectation that the Federal Reserve will begin to ease its restrictive monetary policies as inflation becomes more manageable.

What’s Your Target Rate?

As the rates continue trending downward, it’s essential to consider what rate would make you feel comfortable enough to start your home search. Whether it’s 6.5%, 6.0%, or even lower, the rate you choose should align with your financial situation and long-term goals. Here are some key questions to help you identify your target rate:- What monthly payment can I comfortably afford?

- How much of a down payment am I planning to make?

- How long do I plan to stay in the home?

- What impact will different interest rates have on my overall budget?

- How much have home prices in my desired area changed recently?

- Am I prepared to act quickly if rates hit my target?

Answering these questions can help you determine a rate that makes sense for your budget and future plans.

Why Waiting Could Cost You

While it might be tempting to wait for rates to drop even further, it’s important to consider what that could cost you. For every 1% drop in mortgage rates, approximately 5 million more households become eligible to buy a home. This increase in competition could lead to multiple offers on the homes you’re interested in, making it harder to secure your dream home.Moreover, the perfect home might not be on the market forever. If you wait too long, you might miss out on your ideal property because someone else was ready to act when rates hit their target.

How to Stay Prepared

Once you’ve established your target rate, you don’t need to monitor rates daily. Instead, consider partnering with a trusted mortgage professional who can keep an eye on the market for you. They can notify you when rates reach your desired level, ensuring that you’re ready to act when the opportunity arises.At Luminate Home Loans, we also monitor the rate environment for refinancing opportunities, so you can take advantage of a lower rate later if they continue to drop. Our philosophy? Date the rate, marry the house. By securing your dream home now, you can always refinance to a better rate when the opportunity arises.

In Conclusion

If you’ve been holding off on purchasing a home due to higher mortgage rates, now is an opportune time to reassess your plans. Remember – just a 1% drop in rates could bring millions of new buyers into the market, increasing competition and making it harder to find and secure your ideal home.Talk to your lender about setting a target rate that aligns with your financial goals, and work closely with them to stay informed. By being proactive and setting a clear target, you’ll be better positioned to take advantage of favorable market conditions and make a confident, informed decision when the time is right.

When you’re ready, we’re ready — reach out to us if you have any questions. And remember, with our “Buy Now, Sell Later” program, we can help you navigate your home-buying journey with confidence.