No, A 'Housing Recession' Does Not Mean Falling Home Prices

webadmin • November 6, 2023

No, A 'Housing Recession' Does Not Mean Falling Home Prices

Earlier this week, an article was posted to fortune.com with this headline:

The housing market is headed back to a 1980s-style recession, Wells Fargo says—and it’s all because of ‘higher for longer’ mortgage rates

On first read, this clearly sounds like a warning that home prices are going to fall because of high mortgage rates. But if you actually read the article, you would find a different story:

The bank expects worsened affordability in the near term as mortgage rates remain elevated, which will in turn weaken housing activity. Home prices will continue to appreciate at a slightly slower pace because of underlying demand and tight supply, rising 1.8% by the end of this year, as tracked by Case-Shiller, and 2.5% in 2024. In 2025, Wells Fargo forecasts home prices will rise 4.4%.

The article even painted a positive picture for the near-term future of mortgage rates:

Assuming Wells Fargo’s forecast that the Fed has finished hiking interest rates and will lower them next year is accurate, mortgage rates should also move lower…The average 30-year fixed mortgage rate would finish off this year at 6.94%...Next year, the bank forecasts the average 30-year fixed mortgage rate will be 6.39%—and in 2025, it’ll sink lower still, to 5.70%.

So, headlines today sound like the housing market is heading into a massive recession, but mortgage rates are forecasted to go down and home prices are forecasted to go up. What gives?

Yes, we are experiencing a housing recession today, but it is not a recession of home PRICES – it is only a recession of ACTIVITY in the market. Home prices and mortgage rates do not have an inverse relationship, like most people believe. Just look at history and you’ll see that it’s perfectly normal for home prices and interest rates to rise simultaneously. This is not a new phenomenon.

However, home sales definitely slow down when the cost of financing rises. That is the ‘housing recession’ we are experiencing today.

The housing market is headed back to a 1980s-style recession, Wells Fargo says—and it’s all because of ‘higher for longer’ mortgage rates

On first read, this clearly sounds like a warning that home prices are going to fall because of high mortgage rates. But if you actually read the article, you would find a different story:

The bank expects worsened affordability in the near term as mortgage rates remain elevated, which will in turn weaken housing activity. Home prices will continue to appreciate at a slightly slower pace because of underlying demand and tight supply, rising 1.8% by the end of this year, as tracked by Case-Shiller, and 2.5% in 2024. In 2025, Wells Fargo forecasts home prices will rise 4.4%.

The article even painted a positive picture for the near-term future of mortgage rates:

Assuming Wells Fargo’s forecast that the Fed has finished hiking interest rates and will lower them next year is accurate, mortgage rates should also move lower…The average 30-year fixed mortgage rate would finish off this year at 6.94%...Next year, the bank forecasts the average 30-year fixed mortgage rate will be 6.39%—and in 2025, it’ll sink lower still, to 5.70%.

So, headlines today sound like the housing market is heading into a massive recession, but mortgage rates are forecasted to go down and home prices are forecasted to go up. What gives?

Yes, we are experiencing a housing recession today, but it is not a recession of home PRICES – it is only a recession of ACTIVITY in the market. Home prices and mortgage rates do not have an inverse relationship, like most people believe. Just look at history and you’ll see that it’s perfectly normal for home prices and interest rates to rise simultaneously. This is not a new phenomenon.

However, home sales definitely slow down when the cost of financing rises. That is the ‘housing recession’ we are experiencing today.

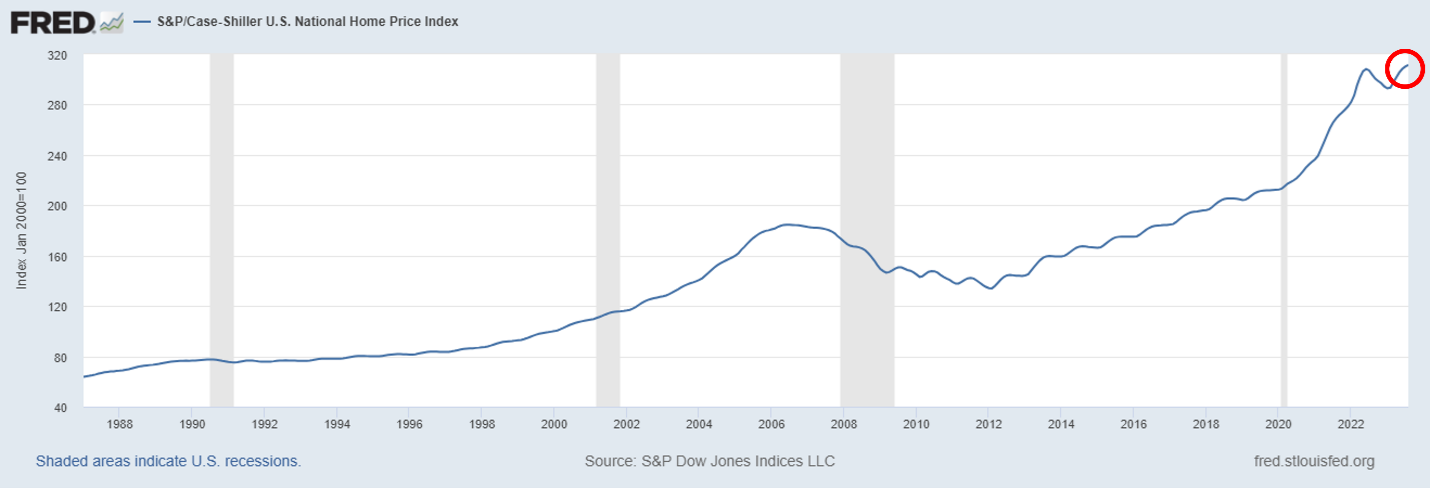

Why Home Prices Still Rise When Rates are High

Even though mortgage rates are more than double what they were three years ago, home prices are still rising. According to the most recent CoreLogic Case-Shiller Index, prices rose 0.4% in August and were 2.6% higher than a year ago.

How could home prices outperform with mortgage rates rising?

More jobs and increased wages, combined with a low-interest rate environment, increased the money circulating in the economy and led to a lot more consumer spending and an increase in prices. Home prices were not immune to this.

Unfortunately, this also resulted in high inflation, which is why the Federal Reserve has raised its own policy rate 11 times since early last year. Inflation has cooled significantly, and the Fed paused rate hikes in its meeting on November 1 st , but this economic strength has coupled with the severe lack of for-sale inventory to propel home prices higher.

This happens for obvious reasons, the main one being a lack of affordability. Fewer home buyers can qualify when financing costs are prohibitively high. Homebuyers may have seen their wages increase and they may have good jobs, but they are dealing with higher costs of living because of inflation. They have probably taken on a lot more debt, as well, so their debt-to-income ratios are not as favorable.

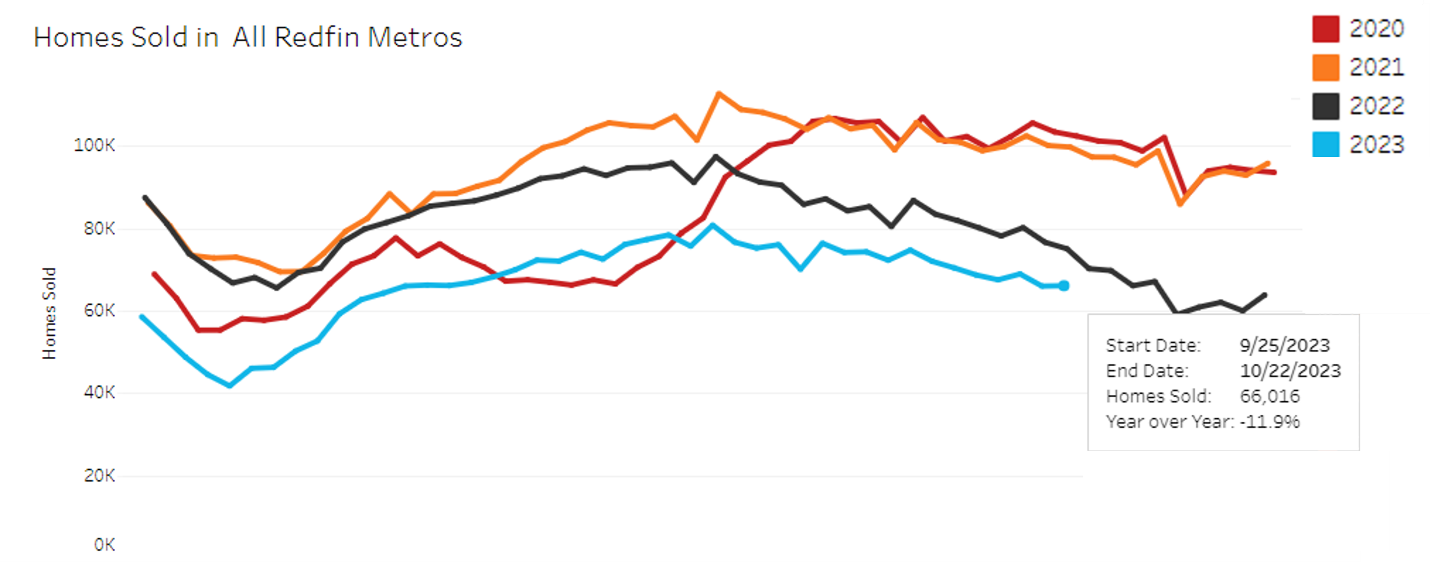

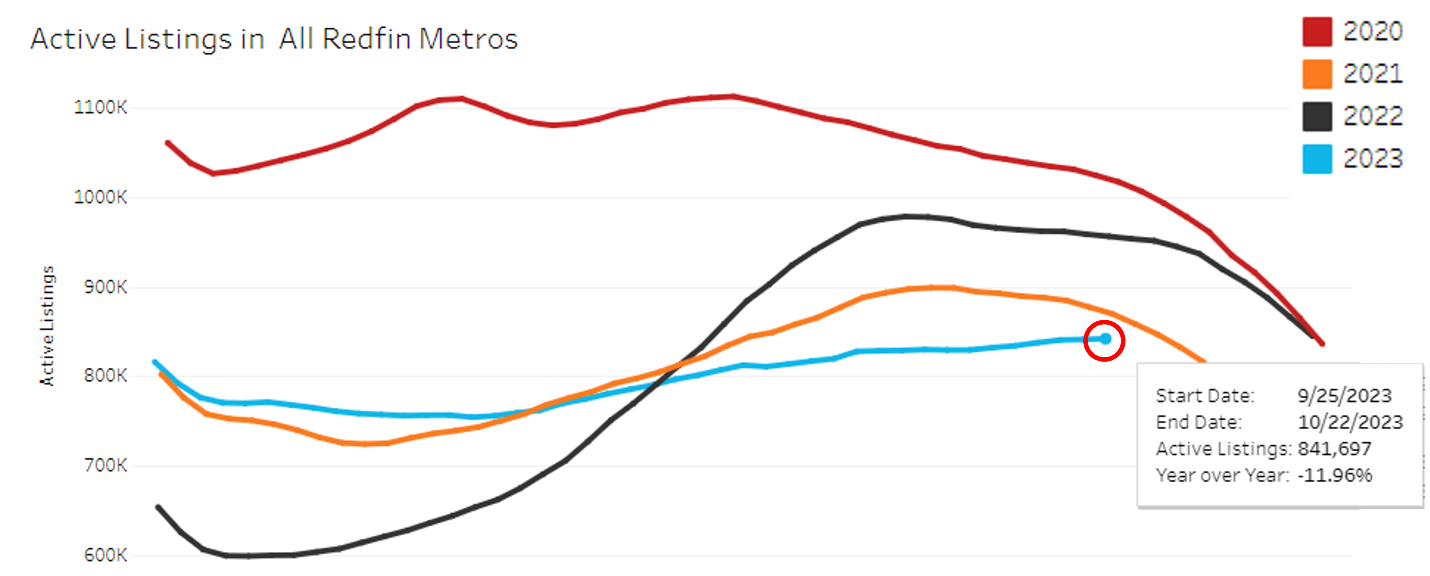

Per Redfin, current home sales are down 11.9% from this time last year and are now at their lowest sales pace since October 2010. For reference, in June of 2021, home sales hit their highest level since 2006.

More jobs and increased wages, combined with a low-interest rate environment, increased the money circulating in the economy and led to a lot more consumer spending and an increase in prices. Home prices were not immune to this.

Unfortunately, this also resulted in high inflation, which is why the Federal Reserve has raised its own policy rate 11 times since early last year. Inflation has cooled significantly, and the Fed paused rate hikes in its meeting on November 1 st , but this economic strength has coupled with the severe lack of for-sale inventory to propel home prices higher.

High Rates Severely Affect Homebuying Activity

On the other hand, when mortgage rates increase significantly, home sales tend to take a big hit.This happens for obvious reasons, the main one being a lack of affordability. Fewer home buyers can qualify when financing costs are prohibitively high. Homebuyers may have seen their wages increase and they may have good jobs, but they are dealing with higher costs of living because of inflation. They have probably taken on a lot more debt, as well, so their debt-to-income ratios are not as favorable.

Per Redfin, current home sales are down 11.9% from this time last year and are now at their lowest sales pace since October 2010. For reference, in June of 2021, home sales hit their highest level since 2006.

Meanwhile, the inventory of active listings has slowly been rising, but it is still down nearly 12% since this time last year.

But despite less demand and fewer buyers, the lower number of sales isn’t resulting in lower prices. Instead, we have a housing market with low demand and low supply and not a lot of budging from sellers on price.

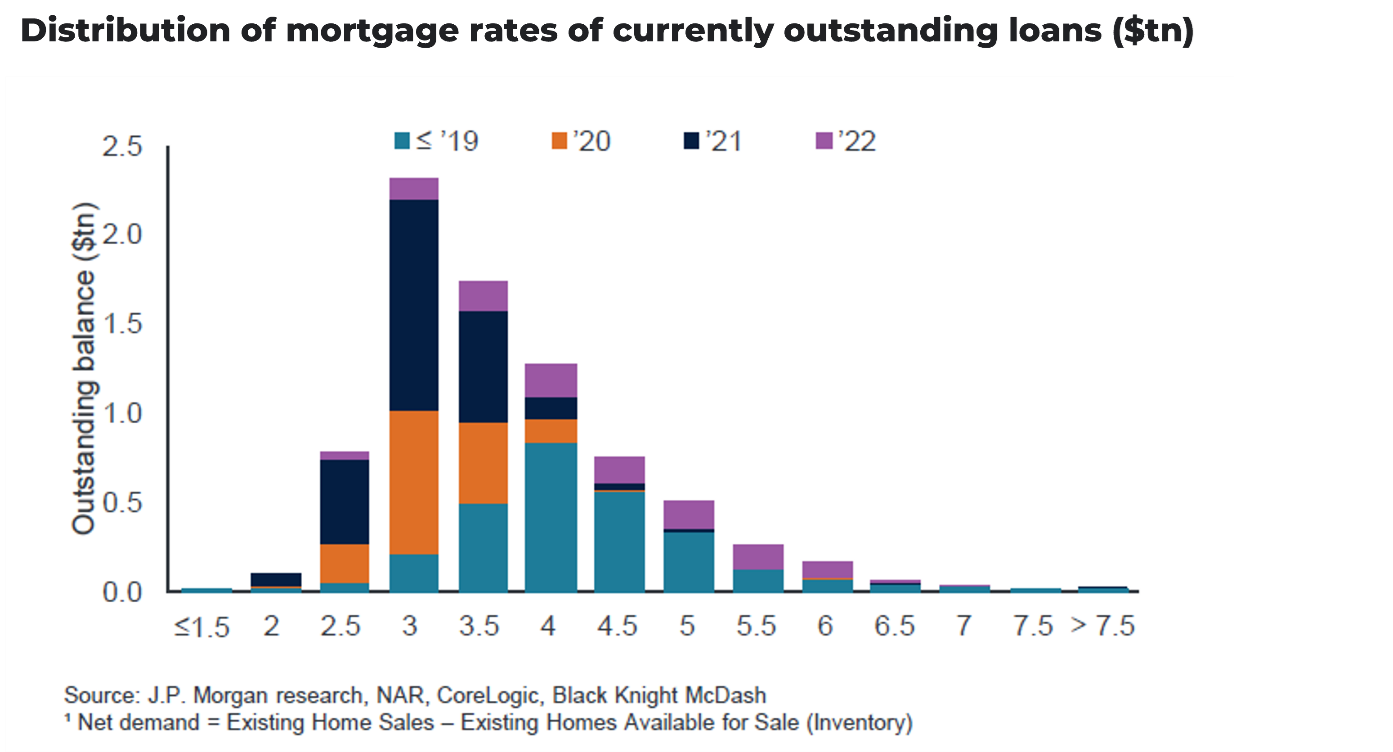

While there has been some debate about the mortgage rate lock-in effect, there’s no denying how strong of a force it is in today’s housing market when you look at the distribution of rates out there today.

Existing homeowners aren’t moving because their mortgage rates are so low. But it’s not only that they’re so low, it’s also the cost of replacement, with prevailing market rates now edging closer to 8%.

Nobody is Selling, and There are Not Enough Homes Being Built

Existing homeowners aren’t moving because their mortgage rates are so low. But it’s not only that they’re so low, it’s also the cost of replacement, with prevailing market rates now edging closer to 8%.

And this isn’t just a small number of homeowners. Nearly two-thirds of all mortgages out there today have an interest rate below 4%, and nearly a quarter have a rate below 3%. Most of these homeowners will not budge and will continue to enjoy their low, fixed-rate mortgage for many years to come.

Why would these owners ever want to sell? Why wouldn’t they rent out their homes and enjoy the cashflow from rents that have been pushed higher due to inflation while benefitting from their 30-year fixed mortgage rates that are well below the real rate of inflation?

In a new survey from Fannie Mae, researchers argued that even if mortgage rates were to decline by a meaningful amount in the intermediate term, they would not expect to see a big surge in for-sale listings. They believe there are a “confluence of factors and trends contributing to the lack of housing inventory in the United States.”

Low-rate homeowners are keeping existing home supply out of the market, but builders are also having trouble bringing new homes to the market. The Associated Builders and Contractors reports that building material costs have increased by 37.7% since 2020. Since 2022, lumber has come down in price by 12.3%, while concrete products have increased by 14.8%.

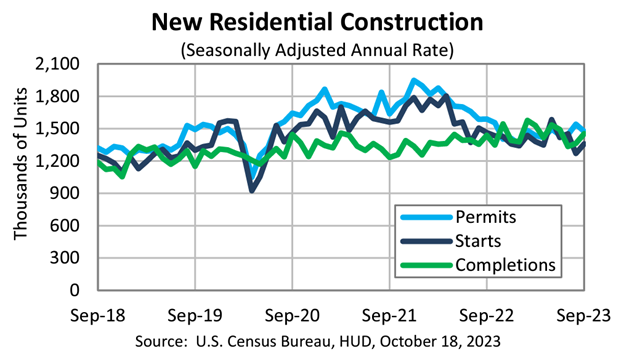

Builders still face significant labor shortages, too. While there’s not a shortage of projects, there’s an increasing challenge to find qualified workers to complete these jobs. On top of that, construction equipment prices are up by 12.2% since 2022. As you can see from the chart below from census.gov, housing permits and starts have fallen quite a bit since last year, and completions have remained relatively flat. If permits and starts are falling, we will start to see completions fall in the coming months, as well.

Why would these owners ever want to sell? Why wouldn’t they rent out their homes and enjoy the cashflow from rents that have been pushed higher due to inflation while benefitting from their 30-year fixed mortgage rates that are well below the real rate of inflation?

In a new survey from Fannie Mae, researchers argued that even if mortgage rates were to decline by a meaningful amount in the intermediate term, they would not expect to see a big surge in for-sale listings. They believe there are a “confluence of factors and trends contributing to the lack of housing inventory in the United States.”

Low-rate homeowners are keeping existing home supply out of the market, but builders are also having trouble bringing new homes to the market. The Associated Builders and Contractors reports that building material costs have increased by 37.7% since 2020. Since 2022, lumber has come down in price by 12.3%, while concrete products have increased by 14.8%.

Builders still face significant labor shortages, too. While there’s not a shortage of projects, there’s an increasing challenge to find qualified workers to complete these jobs. On top of that, construction equipment prices are up by 12.2% since 2022. As you can see from the chart below from census.gov, housing permits and starts have fallen quite a bit since last year, and completions have remained relatively flat. If permits and starts are falling, we will start to see completions fall in the coming months, as well.

As the Economy Slows, Rates Will Come Down

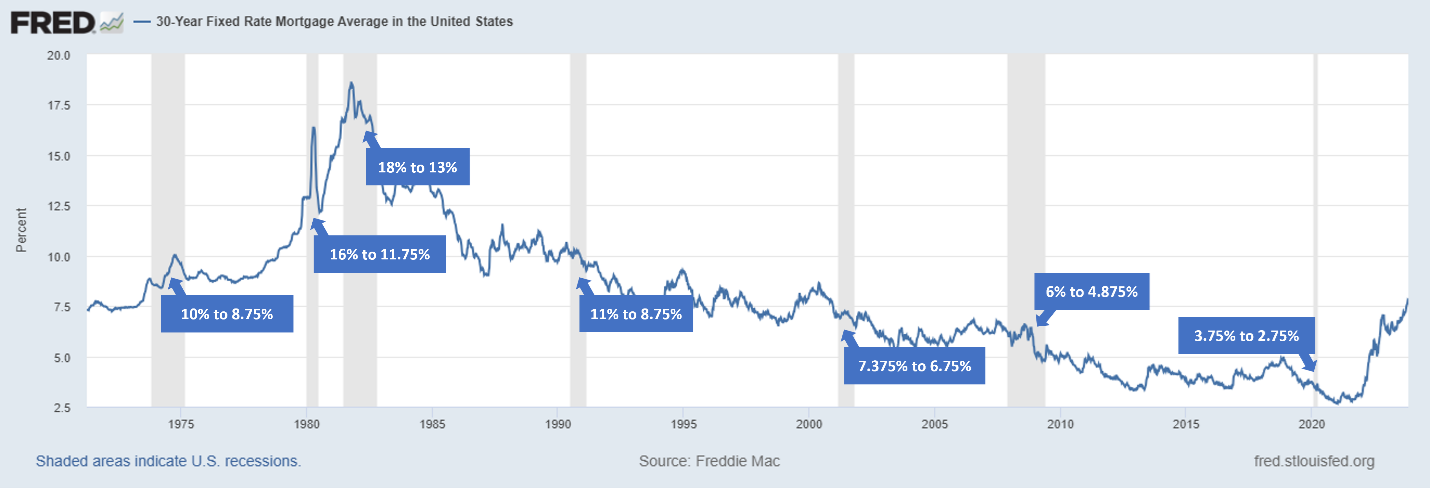

The most recent recession was the COVID-19 recession that lasted from February to April of 2020. It was very short-lived, but it caused 30-year fixed mortgage rates to fall from 3.75% to their bottom of 2.75% in January 2021.

During the Great Recession, which spanned from December 2007 to June 2009, rates started around 6% and fell to roughly 4.875%. That recession was caused by the mortgage crisis, and the loose home loan lending collapsed the global financial system.

In the early 2000s recession, from March 2001 to November 2001, rates began at 7.375% and fell to 6.75%.

In the early 1990s recession, from July 1990 to March 1991, mortgage rates fell from around 11% to 8.75%.

The prior recession, from July 1981 to November 1982, saw rates plummet from the record high of 18% down to 13%.

And the 1980 recession from January 1980 to July 1980 saw rates move lower from 16% to 11.75%.

In all instances, mortgage rates went down during and immediately following the recession. And what will happen when rates come down? We agree with what real estate mogul Barbara Corcoran recently said:

The days of the 2 or 3% interest rates are never going to come again. Forget about that, but they will come down. The minute they drop and come down to anything with a five in front of it, the whole world is going to jump back into the market, there's going to be no houses around and prices are going to go up by 10% or even 15% — so don't get out of the market.

Home prices will continue rising over the long term like they always have. The home you want is going to be more expensive a year from now. Buying today means you will be able to lock in your home’s price before housing costs increase even more. If interest rates do go down as predicted, you can refinance to a permanently lower rate.

And remember, because interest rates are high right now, fewer people are buying. This means you won’t have as much competition when you make offers, and it’s likely you will have some negotiating power to secure a lower price or seller credits to reduce your costs even more. We understand that everyone’s situation is different. Before making any decisions on your homebuying plans, it’s crucial that you look at the numbers for your specific purchase scenario and financial situation.

If you would like to know more about your options for purchasing a home today, fill out the form below to schedule a consultation with one of our mortgage advisors. They will answer all your questions and create a detailed loan comparison so you can create a solution that is best suited to fit your needs.

During the Great Recession, which spanned from December 2007 to June 2009, rates started around 6% and fell to roughly 4.875%. That recession was caused by the mortgage crisis, and the loose home loan lending collapsed the global financial system.

In the early 2000s recession, from March 2001 to November 2001, rates began at 7.375% and fell to 6.75%.

In the early 1990s recession, from July 1990 to March 1991, mortgage rates fell from around 11% to 8.75%.

The prior recession, from July 1981 to November 1982, saw rates plummet from the record high of 18% down to 13%.

And the 1980 recession from January 1980 to July 1980 saw rates move lower from 16% to 11.75%.

In all instances, mortgage rates went down during and immediately following the recession. And what will happen when rates come down? We agree with what real estate mogul Barbara Corcoran recently said:

The days of the 2 or 3% interest rates are never going to come again. Forget about that, but they will come down. The minute they drop and come down to anything with a five in front of it, the whole world is going to jump back into the market, there's going to be no houses around and prices are going to go up by 10% or even 15% — so don't get out of the market.

The Bottom Line

And remember, because interest rates are high right now, fewer people are buying. This means you won’t have as much competition when you make offers, and it’s likely you will have some negotiating power to secure a lower price or seller credits to reduce your costs even more. We understand that everyone’s situation is different. Before making any decisions on your homebuying plans, it’s crucial that you look at the numbers for your specific purchase scenario and financial situation.

If you would like to know more about your options for purchasing a home today, fill out the form below to schedule a consultation with one of our mortgage advisors. They will answer all your questions and create a detailed loan comparison so you can create a solution that is best suited to fit your needs.

By webadmin

•

February 16, 2025

Here at Luminate Home Loans, we’re always looking for ways to offer more value to our clients and partners. That’s why we’re thrilled to announce that we’re now a wholly owned subsidiary of Luminate Bank®—and soon, we’ll officially transition under the Luminate Bank® name.

By Luminate Marketing Team

•

February 4, 2025

Luminate Bank® Welcomes Josh Eifert as Chief Financial Officer, Honoring Legacy of Dave Turk [Minneapolis, Minn.] – [2/4/2025] – Luminate Bank® is proud to announce the appointment of Josh Eifert as its new Chief Financial Officer, succeeding Dave Turk, who has played a pivotal role in shaping the company's strong financial foundation. Josh brings a wealth of experience and strategic vision to Luminate Bank, with 26 years in the banking industry. Most recently, Josh served as CFO at Tradition Capital Bank in Edina, Minnesota, where he led the financial strategy during its remarkable growth from $300 million to more than $2.5 billion in total assets. Before his tenure as CFO, Josh contributed to Tradition Capital Bank in other key financial roles. He began his career with Norwest and Wells Fargo Banks, gaining extensive expertise in financial and operational capacities. Luminate Bank's leadership transition reflects the company's thoughtful succession planning, ensuring its financial strategies remain robust and forward focused. Under the leadership of Dave Turk, Luminate Bank has built an exceptional financial infrastructure, delivering consistent results and creating a foundation that positions the company for continued success. Luminate Bank's CEO, Marc Campbell, shared his confidence in the appointment: "Josh not only brings exceptional financial acumen and strategic insight to Luminate Bank, but he also embodies the principles that define our organization: integrity, innovation, and a steadfast commitment to excellence," Luminate Bank's CEO, Marc Campbell, shared with confidence. "His leadership will ensure our financial strategies succeed and inspire confidence across all who depend on us." "I am honored to join Luminate Bank at such an exciting time. The company's remarkable history of financial excellence and its forward-thinking approach align perfectly with my values and vision," stated Josh Eifert. "I look forward to collaborating with the talented leadership team to build on this strong foundation and drive continued success for our customers, employees, and stakeholders." Josh graduated from the University of Minnesota with a degree in finance and completed the Graduate School of Banking at Colorado. CEO Marc Campbell expressed gratitude for retiring CFO Dave Turk's contributions, saying, "Dave has been instrumental in positioning Luminate as a financial leader. His dedication, insight, and stewardship will always be a part of our company's legacy." Josh Eifert will officially assume his role on February 18, 2025. About Luminate Bank® At Luminate Bank, We Open Doors—empowering individuals and families to achieve their financial dreams through personalized service and innovative digital solutions. As a nationwide bank headquartered in Minneapolis, Minnesota, we are committed to helping our clients meet their financial goals with a blend of modern technology, traditional values, and the trusted guidance of experienced professionals. Known for our exceptional commitment to customers, we take pride in delivering a seamless, supportive experience for every step of the journey. Our dedicated mortgage division has branches and a team of loan originators across the US, making expert home financing solutions accessible to communities nationwide. Luminate Bank is committed to safeguarding your money and accounts with FDIC insurance coverage up to applicable limits. Learn more about how we can open doors for you at www.luminate.bank , follow us on Instagram, LinkedIn, and Facebook, or call (952) 939-7200. For media inquiries, please contact: Debbie Schwake, CMO debbie.schwake@luminate.bank

Have a question or concern for our team?

We're ready to help!

COMPANY

Luminate Bank